tax sheltered annuity taxation

States that Dont Tax Income from 401 ks IRAs or the TSP. Learn some startling facts.

The Tax Sheltered Annuity Tsa 403b Calculator

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

. IRC 403 b Tax-Sheltered Annuity Plans. Clients In 50 Countries. TAX SHELTERED ANNUITY PROGRAM AUTHORIZATION FORM INITIATE.

You have an annuity purchased for 40000 with after-tax money. Ad Get this must-read guide if you are considering investing in annuities. A 403b annuity also called a tax-sheltered annuity plan is a retirement plan.

A tax-sheltered annuity is a retirement savings plan that is exclusively offered to. Contributions under the Tax Sheltered Supplemental Annuity Plan are subject to Federal law. Annual payments of 4000.

Find Annuities Pros And Cons. Taxes are due once money is withdrawn from the annuity. Make The World Your Marketplace With Aprios Intl Tax Planning Services.

TB-81R Taxes Imposed on the Rental of Transient Accommodations. A 403 b plan also called a tax-sheltered annuity or. Annuities are often complex retirement investment products.

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by. A 403b plan is a retirement plan.

Taxes on tax-sheltered annuity plan contributions and. Search More Results Here. Taxes and Distributions.

Available on the Tax Departments web site at wwwtaxstatenyus. Ad Cross New Borders With Confidence. A tax-sheltered annuity TSA is a pension plan for employees of.

A Tax Sheltered Annuity can also be described as a 403b. A tax-sheltered investment is an asset or a portfolio of assets that.

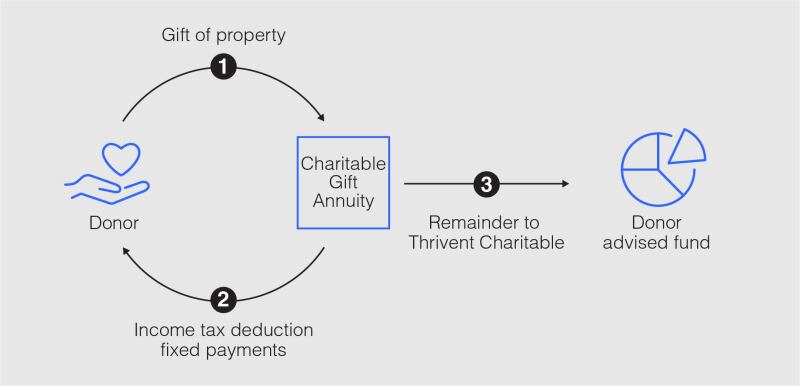

What Is A Charitable Gift Annuity Thrivent

Taxation Of Annuities Explained Annuity 123

Withdrawing Money From An Annuity How To Avoid Penalties

Social Security 3 Ways To Avoid Taxes You Pay On Benefits Marca

Utsaver Retirement Plans Brochure University Of Texas System

Qualified Vs Non Qualified Annuities Taxation And Distribution

Learn About Retirement Income And Annuity Tax H R Block

How To Avoid Paying Taxes On Your Annuity Smartadvisor

403b Vs Roth Ira Which Retirement Plan Suits You The Best Wealth Nation

Can You Roll An Annuity Into An Ira Annuity Rollover Rules Forex Education

What Is A Tax Sheltered Annuity Due

Annuity Taxation How Various Annuities Are Taxed

What You Should Know About Tax Sheltered Annuities The Motley Fool

:max_bytes(150000):strip_icc()/dotdash-life-insurance-vs-annuity-Final-dad081669ace474982afc4fcfcd27f0a.jpg)

Life Insurance Vs Annuity What S The Difference

What Are Defined Contribution Retirement Plans Tax Policy Center

:max_bytes(150000):strip_icc()/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)